INCENTIVE LAWS

What is it?

The federal, state and municipal governments each have a tax exemption model to encourage culture, sport and social activities. In short, Governments give up part of their taxes to sponsor various projects. Therefore, through tax deduction, people and companies have the option of allocating part of the tax to cultural, sporting and social projects of theirchoice. With this sponsorship, projects have a greater chance of happening. Good for the company, good for all of us.

Why encourage?

Zero cost!

Help your country and still have compensation.

The resource is available to everyone.

Zero cost!

Help your country and still have compensation.

The resource is available to everyone.

Reunion Sports registers, approves and executes projects in the most important incentive mechanisms in Brazil:

The spheres of law.

Summary of Federal Laws:

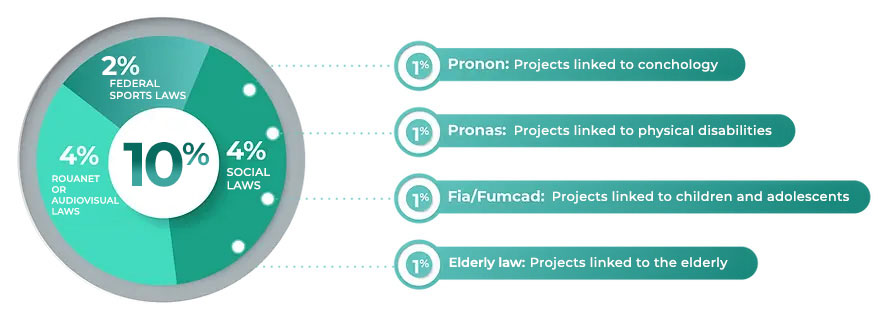

Rouanet Law: The Federal Culture Incentive Law is the name given to Law No. 8,313 of December 23, 1991. The main highlight of the Rouanet law is the tax incentive policy that allows companies (legal entities) and citizens (individuals) ) apply part of the IR (income tax) due to cultural actions. The available percentage is 7% of IRPF for individuals and 4% of IRPJ for legal entities. Types of projects that benefit: Museums, theaters, cinema, musicals, exhibitions, books, among others.

Federal Sports Law: Federal Law No. 11,438 on Sports Incentives – LIE is a law that establishes the possibility for people and companies to invest part of what they would pay in Income Tax in sports projects approved by the government. Companies can deduct up to 2% of income tax due in each calculation period, individuals can deduct a maximum of 7% from donations. Types of projects: Olympic sports, motorsport, team sports, clubs, among others.

Pronon: The National Cancer Care Support Program (Pronon) was established by Law 12,715/12 and allows companies taxed on real profit and individuals opting for the full declaration model to allocate up to 1% of their Income Tax to entity projects philanthropic organizations in the oncology field.

Pronas: The National Health Care Support Program for Persons with Disabilities – PRONAS/PCD was defined and legalized in Law 12715 of 2012. This law established this program with the purpose of capturing and channel resources (1% of Income Tax) aimed at stimulating and developing the prevention and rehabilitation of people with disabilities.

Elderly Law: Law No. 12,213, of January 2, 2010. Establishes the National Elderly Fund and authorizes deduction from income tax (1% of tax due) by individuals and legal entities for donations made to Municipal, State and National Funds of the Elderly; and amends Law No. 9,250, of December 26, 1995.

FIA/Fumcad: Municipal Fund for Children’s Rights

and Adolescents, Federal Law No. 8,069/90 and Municipal Law 11,247/92 is a Public Fund

that aims to finance projects that work to guarantee the promotion, protection and defense of

the rights of children and adolescents. Contributors can make donations

to the Fund for Children and Adolescents – FIA direct

of the Annual Income Tax Adjustment Declaration

(1% of tax due).

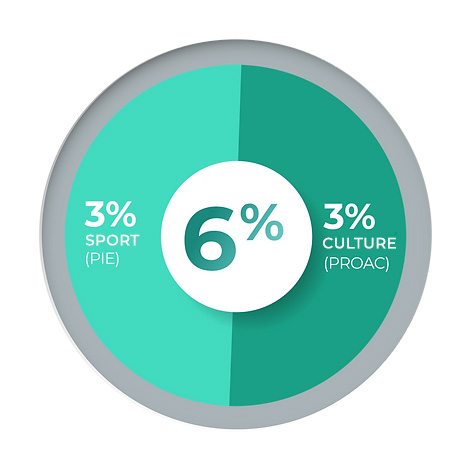

State: ICMS - STATE LAW - SP

LPIE: São Paulo State Law No. 13,918, Article 16, Decree 55636/10 of March 26, 2010 – São Paulo Sports Incentive Law – LPIE, authorizes the executive branch to release the credit corresponding to the value of ICMS allocated by the respective contributors to sports projects approved by the Department of Sports, Leisure and Youth of the State of São Paulo. The sports are as varied as possible and range from Olympic, extreme, motorsport to football.

PROAC: Cultural Action Program is legislation to encourage culture in the State of São Paulo created in 2006 through Law nº 12,268/2006. Initially known by the acronym PAC, the following year it was renamed ProAC to avoid confusion with the Growth Acceleration Program. ProAc finances artistic activities such as theater, dance, circus, audiovisual, comics, among others, offering, through annual notices, values for the financial viability of projects of different sizes and styles.

Municipal: MUNICIPAL LAW

LPIE: São Paulo State Law No. 13,918, Article 16, Decree 55636/10 of March 26, 2010 – São Paulo Sports Incentive Law – LPIE, authorizes the executive branch to release the credit corresponding to the value of ICMS allocated by the respective contributors to sports projects approved by the Department of Sports, Leisure and Youth of the State of São Paulo. The sports are as varied as possible and range from Olympic, extreme, motorsport to football.

PROAC: Cultural Action Program is legislation to encourage culture in the State of São Paulo created in 2006 through Law nº 12,268/2006. Initially known by the acronym PAC, the following year it was renamed ProAC to avoid confusion with the Growth Acceleration Program. ProAc finances artistic activities such as theater, dance, circus, audiovisual, comics, among others, offering, through annual notices, values for the financial viability of projects of different sizes and styles.

Other state laws we work with

- ICMS MG Law (culture and sport);

- ICMS RS Law – Pro Esporte;

- ICMS RJ Law (culture and sport).